Mike Alfred Bitcoin - Insights For Investors

When we think about the evolving world of money and investments, it is often helpful to hear from those who spend a great deal of time observing how things change. Mike Alfred, for instance, is someone whose perspective on digital assets, particularly Bitcoin, catches the attention of many. He has a way of looking at the market that combines a long history in finance with a willingness to consider newer forms of wealth. His thoughts often center on where Bitcoin might be headed next, and what forces are truly shaping its path.

You see, for a good while now, Bitcoin has been in what some might call a waiting phase, not really making big moves up or down. Yet, Mike Alfred has voiced an opinion that this period of calm might be nearing its end. He suggests, in a way, that Bitcoin could be right on the verge of a significant upward swing in its price. This idea, you know, comes from his close watch on market happenings and what makes prices shift, especially when it comes to something as talked about as Bitcoin.

His observations, which he shared recently, point to a particular reason for this potential change. It appears that big organizations, rather than individual buyers, are the ones now making the most noticeable moves in the Bitcoin space. This is a bit of a departure from what we have seen before, where many smaller investors played a bigger part in price changes. So, it's almost as if the very nature of who is buying Bitcoin is changing, and that, Mike Alfred believes, could mean big things for its value.

- Cwb Chicago News

- Creator Clinic

- Pittsburgh Tribune Review Live

- Eli 1301 Spectrum

- Waffle House Near Atlanta Airport

Table of Contents

- Getting to Know Mike Alfred

- What is Mike Alfred's Take on Bitcoin's Future?

- How Does Mike Alfred See Institutional Involvement with Bitcoin?

- Is Mike Alfred's Investment Approach Unique?

- What is Mike Alfred's Blended Strategy for Bitcoin and Value Investing?

- What Are Some of Mike Alfred's Bitcoin Predictions?

- How Does Mike Alfred View Bitcoin's Current Market State?

- Mike Alfred and the Broader Bitcoin Conversation

Getting to Know Mike Alfred

Mike Alfred is a person with considerable experience in the world of private investing. He has spent a good deal of time as an advisor and also serves on various company boards, which suggests he has a broad view of how different businesses and financial systems operate. He is the person who started Alpine Fox LP and continues to be its managing partner. This group, Alpine Fox LP, is a private investment firm, and it focuses its attention on what are called value equities, which are basically shares in companies that seem to be priced lower than their true worth. Interestingly, it also places a significant emphasis on Bitcoin, making it clear that his firm sees a place for both traditional stock market plays and newer digital assets. His background, you know, provides a helpful foundation for his thoughts on where things might be headed with digital currencies.

- How Old Is Chino Alex

- Bishop Crites Funeral Home Greenbrier Ar

- Strongsville Mustangs

- Ring Is Down

- Carly Jane Onlyfans

His role as a founder and managing partner means he is at the very core of how Alpine Fox LP makes its investment choices. This kind of position requires a deep familiarity with market movements and a clear vision for how to approach different opportunities. The fact that his firm looks at both established company shares and Bitcoin shows a rather flexible approach to making money grow. It suggests a belief that value can be found in different places, whether it is a long-standing company or a relatively new digital currency. So, his insights into Bitcoin are not just random thoughts, but rather, they come from a professional setting where actual money is put to work based on such views.

| Name | Mike Alfred |

| Current Role | Founder & Managing Partner, Alpine Fox LP |

| Previous Experience | Former Tech CEO, Seasoned Private Investor, Advisor, Board Member |

What is Mike Alfred's Take on Bitcoin's Future?

Mike Alfred holds a particular view regarding Bitcoin's future price movements. Even though Bitcoin has, for a period, seemed to be in a holding pattern, not really showing a lot of big ups or downs, he feels that this quiet period might be coming to an end. He has expressed a belief that Bitcoin could very well be standing on the edge of what he calls a "major price breakout." This means he anticipates a time when Bitcoin's value could increase significantly and quite suddenly. It's a hopeful outlook, to be sure, especially for those who have been waiting for the digital currency to make a noticeable move. His perspective, you know, offers a different way to think about the current market quietness.

This idea of a breakout is a significant one in the world of investing. It suggests that after a period of consolidation, where prices stay within a certain range, there is often a moment when they push past those limits with a lot of force. Mike Alfred's statement indicates he sees the conditions lining up for such an event with Bitcoin. He is, in a way, pointing to a potential shift from calm to something far more active in the market. This kind of prediction, coming from someone who studies these things, can certainly make people pay closer attention to how Bitcoin behaves in the coming days and weeks.

How Does Mike Alfred See Institutional Involvement with Bitcoin?

When Mike Alfred shared his thoughts on Bitcoin's recent price activity, he pointed out something rather interesting about who was doing the buying. He observed that the recent upward movement in Bitcoin's value appeared to be mostly driven by what are called "institutional buyers." These are big organizations, like investment funds or large companies, rather than individual people buying small amounts. This observation is quite important because it suggests a change in the kind of money flowing into Bitcoin. It's almost as if the big players are now stepping in, which is a bit different from how things have often worked in the past. This shift, you know, could have a considerable impact on how Bitcoin's price behaves.

He noted that this involvement from larger groups stood in "stark contrast" to what has been seen before. Historically, much of Bitcoin's price action was influenced by a wider group of individual investors. However, if big institutions are now the main drivers, it means that larger sums of money are moving into the market, which can lead to more significant and perhaps more stable price changes. This insight from Mike Alfred highlights a maturing aspect of the Bitcoin market, where it is attracting the attention of very substantial financial entities. So, his view indicates that the source of Bitcoin's recent price spikes might be a sign of a new phase, one where bigger financial players are increasingly shaping its direction.

Is Mike Alfred's Investment Approach Unique?

Mike Alfred is known as a value investor, which is a specific way of looking for opportunities in the market. A value investor typically tries to find assets that they believe are trading for less than what they are truly worth. What makes Mike Alfred's approach particularly interesting, however, is that he has taken this established way of thinking and applied it to Bitcoin. He has, in a way, made a bet on Bitcoin, seeing it as something that could be undervalued or that fits within his value investing framework. This combination of a traditional investment philosophy with a relatively new digital asset is what makes his strategy stand out. It is not something you see every day, and it offers a rather fresh perspective on how to approach the world of digital currencies.

He has even gone so far as to lay out what he considers to be the "ultimate investing strategy" that brings together value investing principles with the world of cryptocurrencies. This suggests he has developed a clear framework for how these two different areas can work together to create opportunities. It is about finding the underlying worth, even in something as new and sometimes unpredictable as Bitcoin. This kind of approach, you know, shows a willingness to adapt proven methods to new financial frontiers. It means his ideas about Bitcoin are not just speculative; they are rooted in a systematic way of thinking about investment potential.

What is Mike Alfred's Blended Strategy for Bitcoin and Value Investing?

Mike Alfred's approach to investing is rather distinctive because he combines the long-standing principles of value investing with the newer opportunities found in the world of digital assets, specifically Bitcoin. Value investing, traditionally, involves carefully looking for companies whose shares are trading at a price lower than their true worth, based on their assets, earnings, and future prospects. Alfred has taken this idea and, you know, applied it to Bitcoin, seeing it through a similar lens of fundamental value. This blending of old and new is what makes his strategy quite compelling, as it suggests that even in a rapidly changing financial landscape, established methods can still be relevant.

He has even discussed how this combined strategy can be put into practice, sharing insights into how one might find what he calls "crypto stocks." These would presumably be companies that are involved in the cryptocurrency space but can still be evaluated using traditional value investing measures. This means looking at their financial health, their business models, and their potential for growth, much like one would with any other company, but with the added consideration of their ties to digital currencies. So, his method is not just about buying Bitcoin outright; it's also about identifying related investment opportunities that fit a value-oriented mindset. It's almost like he is building a bridge between two very different investment worlds, showing how they can, in fact, complement each other for those seeking long-term growth.

What Are Some of Mike Alfred's Bitcoin Predictions?

Mike Alfred has offered some rather specific predictions about where he sees Bitcoin's price heading. He has, for instance, put forth a view that Bitcoin could follow a path that eventually leads it to a value of $300,000. This is a very significant number, and it certainly captures attention, showing a very bullish outlook on the digital currency's potential. When he makes such a prediction, he also talks about the various elements that he believes will drive this kind of growth. He often points to what he calls "institutional drivers," which are the actions and investments made by large financial organizations. These big players, you know, have the capacity to move markets in a way that individual investors might not.

Beyond just the price target, Mike Alfred also discusses the "cycle outlook" for Bitcoin. This refers to the idea that Bitcoin's price movements tend to follow certain patterns or cycles over time, often influenced by events like its halving. By considering these cycles, along with the increasing involvement of large institutions, he forms his long-term views on Bitcoin's potential trajectory. It is, in a way, a comprehensive look at both the immediate influences and the broader historical trends that might shape Bitcoin's future value. So, his predictions are not simply guesses; they are rooted in an analysis of market forces and historical patterns, which gives them a certain weight in the conversation around digital assets.

How Does Mike Alfred View Bitcoin's Current Market State?

Mike Alfred's perspective on Bitcoin's current market situation involves looking back at past events to understand what might be coming next. He has, for example, drawn comparisons between the current market and what happened in 2017. That year, Bitcoin experienced an incredible surge, increasing its value by a staggering 5,600 percent. This kind of historical parallel is interesting because it suggests that similar conditions might be at play now, potentially leading to another period of significant growth. Analysts, too, are making these comparisons, with some even suggesting that Bitcoin could reach a value of $500,000, which is a rather bold prediction, showing just how much potential some see in this digital asset.

Adding to this outlook, Bitcoin has, in fact, recently achieved a new all-time high, surpassing $111,000. This kind of milestone, you know, often sparks renewed interest and confidence among investors. When Mike Alfred discusses these developments, he ties them back to the idea of institutional involvement and the overall market cycle. He seems to suggest that these recent highs are not just random spikes but are part of a larger trend driven by significant players entering the market. So, his view of the current state is one where the groundwork has been laid for substantial future movement, perhaps even echoing the dramatic gains seen in previous cycles. It's almost as if he sees the current market as a prelude to something much bigger, a continuation of Bitcoin's journey toward wider acceptance and higher values.

Mike Alfred and the Broader Bitcoin Conversation

The conversation around Bitcoin is steadily becoming a regular part of discussions between financial advisors and their clients. It is no longer just a topic for tech enthusiasts or those on the fringes of the financial world; it is, in a way, moving into mainstream financial planning. Many people are now comparing Bitcoin to gold, which has traditionally been seen as a safe place to put money during uncertain times. This comparison suggests that Bitcoin is gaining recognition as a valuable asset, perhaps even as a form of digital gold. Mike Alfred's insights contribute to this broader discussion, offering a professional viewpoint on Bitcoin's role in a balanced investment approach.

His firm, Alpine Fox LP, by focusing on both value equities and Bitcoin, shows a practical example of how these two different kinds of assets can be considered together. This approach helps to normalize Bitcoin within the wider investment community. It is about showing that Bitcoin can be analyzed with the same kind of careful thought that goes into choosing traditional stocks. So, when Mike Alfred talks about Bitcoin, he is not just speaking to those already deeply involved in digital currencies; he is also speaking to a wider audience of investors and their advisors who are beginning to explore what Bitcoin might mean for their financial plans. His contributions, you know, help to shape the ongoing dialogue about Bitcoin's place in the future of money and investment.

- Boston Praise Radio

- Pokemon Omega Ruby 3ds Amazon

- Michael Myers Hospital Gown

- Sophie Raiin Spider Man

- Chive On Hump

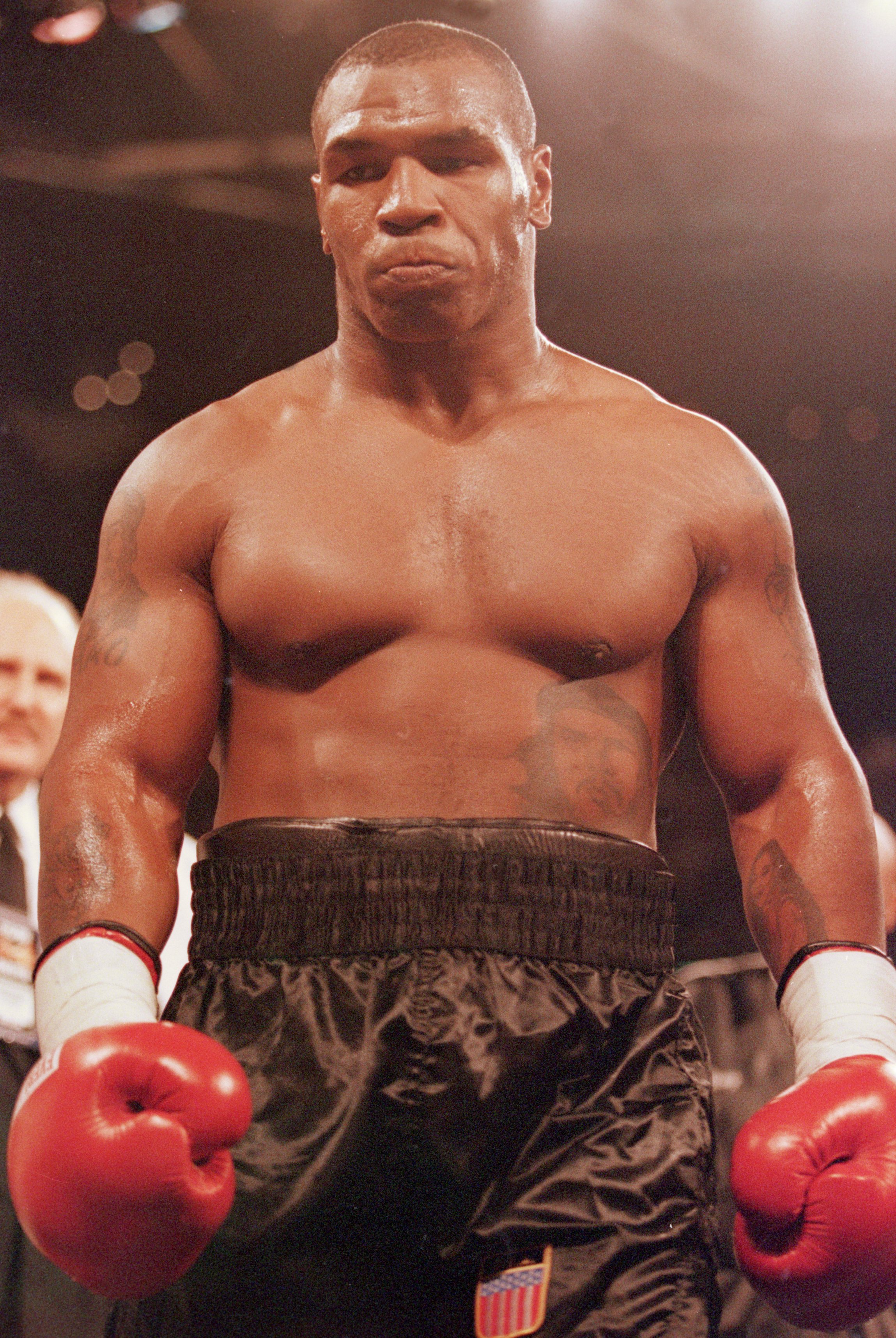

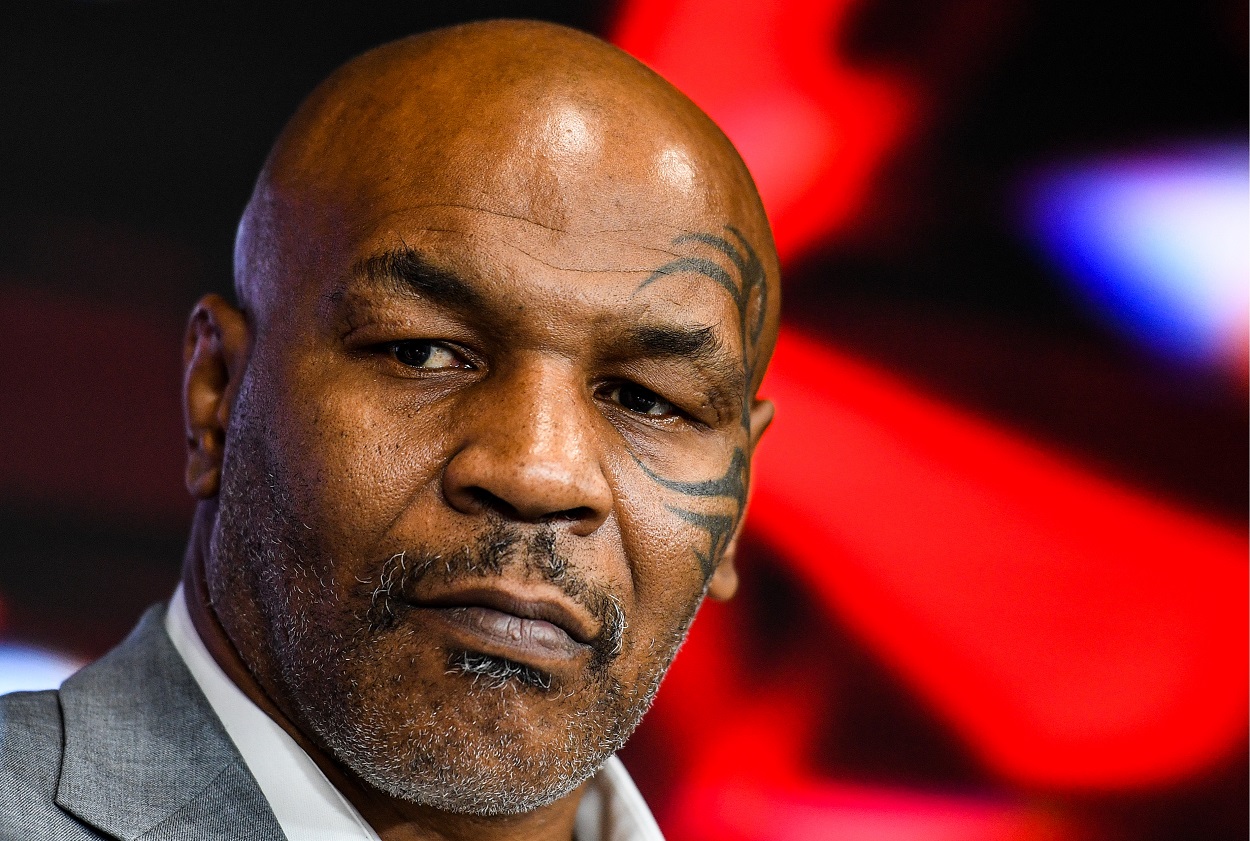

Mike Tyson and the Top 4 Fighters Who Were Both Over and Underrated

Mike Tyson Birthday

Mike Tyson Had 44 KOs During His Boxing Career and 'Iron Mike' Now